AI-Driven Investment Opportunities for the Next 5 Years

A Data-Backed Forecast for the Next 5 Years

Executive Summary

Artificial Intelligence (AI) is rapidly changing many industries, presenting significant investment opportunities. This report identifies key areas within the AI sector poised for growth over the next five years (2025-2030). Using a data-driven approach, it examines the increasing adoption of AI in sectors like fintech, security, and medicine, as well as the infrastructure and platforms that support these applications.

The analysis includes a focus on the importance of scalability, adaptability, and ethical considerations in AI investments, providing a balanced view of potential rewards and risks.

Outline:

Introduction

Key Factors Driving AI Investment (2025-2030)

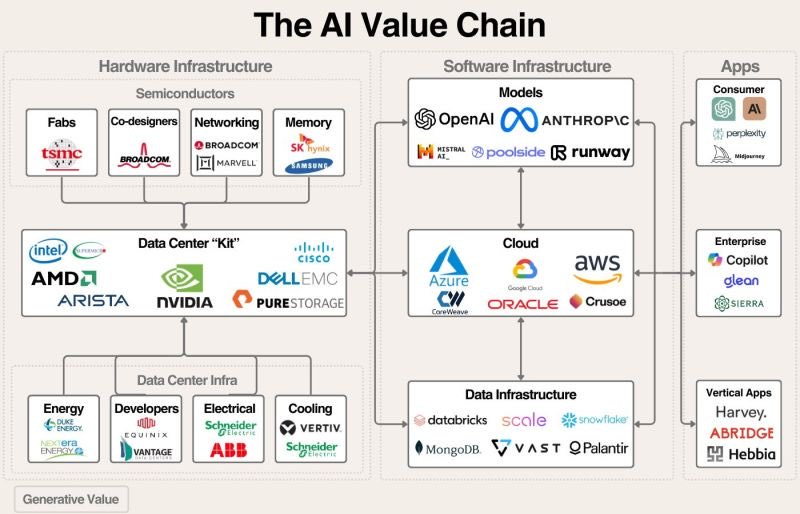

Investment Opportunities Along the AI Value Chain

Regional Analysis

Investment Strategies and Considerations

Risks and challenges in AI investment

Spotlight on Key Companies

Conclusion:

Introduction

Artificial intelligence is no longer a distant promise of the future—it’s here, reshaping industries, automating workflows, and unlocking new levels of efficiency. From streamlining everyday tasks to revolutionizing data analysis, AI is becoming the backbone of innovation across multiple sectors.

For investors, this presents a rare and powerful opportunity. The AI Wealth Playbook isn’t just about understanding AI—it’s about leveraging its transformative power to build wealth. Those who recognize the key trends early will be in the best position to capitalize on the next wave of AI-driven growth.

This report is your data-backed guide to the most promising AI investment opportunities over the next five years. We’ll explore the critical drivers of AI adoption, the high-potential segments within the AI value chain, and the strategies investors can use to navigate this rapidly evolving landscape. If you’re looking to position yourself ahead of the curve, this is your roadmap.

Key Factors Driving AI Investment (2025-2030)

Here are key factors driving AI investment between 2025 and 2030.

1. Shift to Practical, Purpose-Driven AI:

The AI sector is moving away from hype-driven automation and focusing on real-world impact. Investors are showing more interest in companies that offer practical, scalable solutions. Adaptability, collaboration, and domain-specific expertise are becoming key factors. The focus is on solving real problems and building trust.

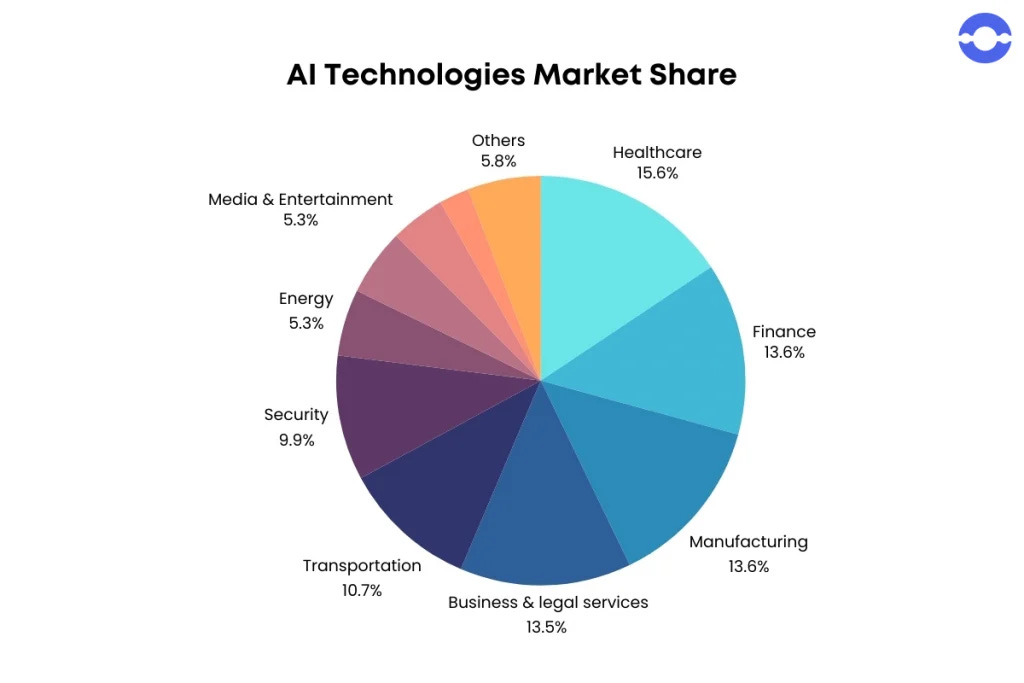

2. Increasing AI Adoption Across Sectors:

Industries such as healthcare, automotive, BFSI (banking, financial services, and insurance), IT, telecommunications, manufacturing, media, and retail are integrating AI solutions to enhance their operations.

3. Government and Private Sector Investments:

Global investment in AI image recognition is increasing as governments and private sectors acknowledge its importance.

The German government has committed EUR 3 billion to AI research and development by 2025.

Saudi Arabia has announced a USD 20 billion investment plan through its National Strategy for Data & AI (NSDAI).

The U.S. National Science Foundation allocated USD 10.9 million to boost AI research, emphasizing safety.

4. AI in Security:

AI plays a crucial role in enhancing threat detection, automating responses to cyberattacks, and analyzing data for anomalies, which improves the overall cybersecurity posture. The rising frequency and sophistication of cyber threats have made traditional security measures insufficient, increasing the demand for AI-driven security solutions.

5. AI in Fintech:

Payment and wealth-focused fintech companies are investing in AI solutions to bolster their infrastructure and handle higher transaction volumes. AI and machine learning benefit banks and fintech companies by processing vast amounts of customer information to provide timely services and products, improving customer relations.

6. Integration with IoT and Edge Computing:

The integration of AI with Internet of Things (IoT) devices and advancements in edge computing are key trends shaping the AI platform market. The surge in mobile and IoT device usage has spurred demand for edge AI solutions. Edge AI hardware facilitates on-device processing, reducing data transfer between the device and the cloud, which ensures real-time performance.

7. Demand for Automation and Advanced Analytics:

There is an increasing demand for automation and advanced analytics across industries, which drives the adoption of AI-based solutions.

8. Growth of AI-as-a-Service (AIaaS):

Companies are integrating AI technology into their applications, businesses, analytics, and services to reduce operational costs and increase profit margins. AIaaS is gaining prominence over the cloud.

9. Cloud AI:

The rising trend of multi-cloud functioning and the growing need for cloud-based intelligence services increase the demand for AI cloud solutions.

10. Monetization of AI Investments:

Increased monetization of enterprises’ AI investments is creating opportunities for data centers, consultants, ad platforms, cloud computing companies, and cybersecurity firms.

Investment Opportunities Along the AI Value Chain

Here are potential investment opportunities along the AI value chain.

1. AI Infrastructure and Hardware:

Cloud Computing:

The cloud AI market is projected to reach USD 89.43 billion in 2025 and grow to USD 363.44 billion by 2030, with a CAGR of 32.37%.

Companies like Microsoft, IBM, Google, and Amazon are expanding their product portfolios and geographical presence to capture a significant market share.

Data Centers and Digital Infrastructure:

As enterprises increase their investments in AI infrastructure, opportunities are emerging for data centers. Data center demand for electricity is set to more than double by 2026 relative to 2022 levels.

Edge AI Hardware:

The edge AI hardware market is expected to grow from USD 4.36 billion in 2025 to USD 10.23 billion by 2030, with a CAGR of 18.58%.

This growth is driven by the demand for heightened realism in virtual reality (VR) environments and the need for real-time, high-performance processing in media and entertainment.

Semiconductors:

Companies that design and manufacture semiconductors are key to generating computing power for AI.

2. AI Platforms and Services:

AI Platforms:

The AI platform market is projected to grow from USD 65.25 billion in 2025 to USD 108.96 billion by 2030, at a CAGR of 10.8%

These platforms offer comprehensive solutions for building, training, and deploying machine learning models.

AI-as-a-Service (AIaaS):

The AI-as-a-Service market is expected to increase from USD 20.64 billion in 2025 to USD 98.82 billion by 2030, exhibiting a CAGR of 36.78%

AIaaS allows companies to experiment with AI for various purposes by limiting initial investment and lowering risk.

Cloud AI:

The Cloud AI Market is anticipated to reach USD 89.43 billion in 2025 and is projected to grow at a CAGR of 32.37% to reach USD 363.44 billion by 2030

3. AI Applications in Specific Industries:

AI in Fintech:

The AI in Fintech market is expected to grow from USD 18.31 billion in 2025 to USD 53.30 billion by 2030, at a CAGR of 23.82%

AI improves results by applying methods derived from the aspects of human intelligence at a broader scale and helps process vast amounts of customer information.

AI in Security:

The AI in Security Market is estimated at USD 30.02 billion in 2025, and is expected to reach USD 71.69 billion by 2030, at a CAGR of 19.02%

AI enhances threat detection, automates responses to cyberattacks, and analyzes vast amounts of data for anomalies.

AI in Medicine:

The Artificial Intelligence in Medicine Market is predicted to increase from USD 31.25 Billion in 2025 to USD 185.84 Billion in 2030, at a CAGR of 42.84%.

AI in the medical sector uses machine learning models to enhance patient outcomes and medical research data.

Enterprise AI:

Enterprise AI has become a key component for enterprise applications and an essential factor for successful business strategies.

4. Emerging Trends:

Multimodal AI:

The Multimodal AI Market is projected to grow from USD 2.99 billion in 2025 to USD 10.81 billion by 2030, at a CAGR of 29.29%

Multimodal AI systems integrate various data formats, such as text, images, videos, and speech, to provide comprehensive insights and understanding.

Generative AI:

The increasing adoption of generative AI tools is a key trend shaping the AI platform market

AI in Robotics:

Artificial intelligence (AI) and edge computing are rapidly reshaping the landscape of robotics, ushering in an era of smarter and more autonomous machines. Though the world generally thinks of robots as primarily hardware, robotics does not necessarily require a hardware component, software robots have become more commonplace in recent years.

Regional Analysis

Here is a regional analysis of AI investment opportunities.

1. North America:

Largest Market Share:

North America is projected to hold the largest market share in AI across multiple sectors in 2025, including AI platforms, AI in Fintech, AI in medicine, AI-as-a-Service, cloud AI, and multimodal AI.

Dominant Sectors:

The United States dominates the North American fintech landscape, holding approximately 94% of the total market share in 2024. Key sectors driving growth include:

digital payments

blockchain technology

AI-driven financial services

Key Factors:

North America benefits from a robust innovation ecosystem fueled by federal investments in advanced technology, the presence of major technology companies, and renowned research institutions. The region's focus on improving large language models (LLMs) and advancing multimodal AI capabilities creates new opportunities for businesses to adopt advanced solutions.

AI in Medicine:

North America is a dominant force in the artificial intelligence in healthcare market, driven by high adoption rates of AI technologies across healthcare and pharmaceutical sectors.

AIaaS:

North America is one of the largest markets for AIaaS solutions, with a robust infrastructure and a highly skilled workforce.

2. Asia Pacific:

Fastest Growing Region:

Asia Pacific is estimated to grow at the highest CAGR across several AI markets between 2025 and 2030, including AI in Fintech, AI in security, AI platforms, AI-as-a-Service, edge AI hardware, enterprise AI, and multimodal AI.

Key Factors:

The Asia-Pacific region is experiencing great strides in the digital economy, which also causes more threat-related opportunities. Increasing internet penetration and the shift toward digitization drive the adoption of cloud-based services.

3. Europe:

Investment and Initiatives:

The German government has committed EUR 3 billion to AI research and development by 2025.

4. Latin America and Middle East & Africa (Rest of the World):

Growth Potential:

These regions show promising growth in the medical AI market. Latin American countries recognize the significance of AI-powered technologies, expecting AI to increase the region's GDP significantly by 2030. The Middle East & Africa region is witnessing growth driven by the expansion of Big Data usage in the healthcare sector and the increasing significance of precision medicine.

Worldwide AI Momentum:

Global Lens: With AI gaining momentum worldwide, domestic champions are rising across Europe and Asia, where valuations are more attractive. For many economies experiencing labor shortages and low productivity growth, AI represents an opportunity for economic development and the creation of new industries entirely.

Investment Strategies and Considerations

Here are investment strategies and considerations for AI.

Focus on Practical and Purpose-Driven AI:

Prioritize companies that demonstrate adaptability, collaboration, and domain-specific expertise.

Look for businesses creating scalable solutions that align with user needs and address specific industry challenges.

Avoid companies chasing "buzzwords" and instead, seek those solving meaningful problems and building trust.

Assess the Company's Understanding of the Target Industry:

Ensure the company has a deep understanding of its target industry.

Verify that solutions are developed with input from subject matter experts and align with clear customer pain points.

Domain-specific AI often benefits from higher adoption rates because it integrates seamlessly into workflows and delivers measurable value.

Evaluate Scalability and Cost Efficiency:

Scalability and cost-effectiveness are important factors to consider when evaluating AI companies.

For Retrieval-Augmented Generation (RAG) systems, look for companies with access to proprietary, high-quality datasets or strong partnerships with live data providers.

Examine whether the company has mechanisms for ensuring the accuracy of retrieved information, especially in industries like healthcare and financial compliance.

Prioritize Modularity and Adaptability:

Focus on companies that prioritize modularity as a way to serve underserved markets and adapt to industry-specific needs.

Look for scalable architectures that let users easily integrate new capabilities.

Risk Management and Regulatory Adaptation:

Assess how a company is mitigating risks associated with AI, such as liability for AI-generated errors and evolving regulatory frameworks.

Check if they are incorporating validation layers to ensure accuracy and reliability.

Determine if they proactively engage with regulators to stay ahead of compliance requirements.

Companies treating risk management and regulatory adaptation as core competencies will have a competitive edge.

Consider the Pace of Enterprise Adoption and Regulatory Developments:

Monitor the pace of agentic AI technology adoption within enterprises, as well as regulatory developments.

Regulation developed in conjunction with industry leaders and key stakeholders will likely create a more stable environment for long-term investment.

Look Beyond Megacap Tech Stocks:

Focus on opportunities that will prevail along the AI value chain, not just megacap tech stocks.

Cheaper valuations and less demanding earnings expectations outside of megacap tech stocks suggest that even AI bulls should be positioned for further broadening across sectors

Diversify Across the AI Value Chain:

Consider opportunities in hardware, hyperscalers, AI essentials, and developers.

A diversified approach will be critical, given the high degree of variability in the future prospects of less established developers.

Global Perspective:

Apply a global lens when exploring AI opportunities, favoring high-quality businesses with proven competitive advantages led by management teams prioritizing long-term performance.

Long-Term Mindset:

Exercise patience and a long-term mindset when seeking opportunities across the AI innovation cycle.

Resist the fear of missing out driven by the allure of quick gains, and take time to truly understand a company’s prospects before investing

Spotlight on Key Companies

Here is a spotlight on key companies in the AI sector.